Building a crypto portfolio can be an exciting and potentially rewarding endeavor, but it requires careful planning and consideration. Below are some essential tips to help you construct a well-balanced and diversified cryptocurrency portfolio.

1. Understand Your Portfolio Risk Tolerance

Cryptocurrencies are highly volatile, with dramatic price fluctuations. Assess your risk tolerance to guide your investment choices.

2. Do Your Research

Research is crucial. Study different cryptocurrencies, their technologies, use cases, and market trends. Reliable sources include whitepapers, crypto news websites, and community forums.

3. Diversify Your Portfolio Investments

Manage risk by diversifying. Avoid putting all your funds into one cryptocurrency. Mix established cryptocurrencies like Bitcoin and Ethereum with newer altcoins that have growth potential.

4. Determine Your Investment Strategy

Choose between a short-term or long-term investment strategy. Day trading offers quick profits but higher risks, while holding long-term can be more stable and profitable over time.

5. Use Reputable Exchanges

Choose secure and reputable cryptocurrency exchanges. Ensure they have strong security measures, good liquidity, and a user-friendly interface.

6. Secure Your Investments

Security is paramount. Use hardware wallets or other secure storage methods to protect your assets. Enable two-factor authentication (2FA) on all accounts and never share your private keys.

7. Stay Updated on Market Trends

The cryptocurrency market is constantly evolving. Stay informed about market trends, regulatory news, and technological developments to make informed decisions.

8. Set Realistic Goals

Set clear and realistic investment goals. Determine what you want to achieve and set benchmarks to measure your progress. Avoid impulsive decisions based on short-term market movements.

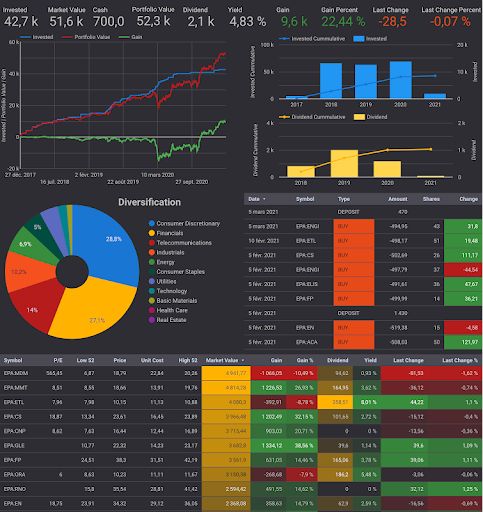

9. Monitor Your Portfolio Regularly

Regularly review your portfolio to assess performance and make necessary adjustments. Rebalancing helps maintain your desired asset allocation and manage risk.

10. Consult with Financial Advisors

If you’re unsure about your investment choices, consider consulting a financial advisor experienced in cryptocurrency investments for valuable insights and guidance.

Building a successful crypto portfolio takes time, patience, and continuous learning. By following these tips, you can create a diversified and resilient portfolio that aligns with your financial goals.

Subscribe to our newsletter!