Apple losing ground: another downgrade due to weak AI and iPhone stagnation

Apple shares continue to fall — now downgraded by Needham, citing poor growth prospects and lack of progress in AI.

Downgrade and reasons — Needham cut its rating from “Buy” to “Hold” — Reasons: intense competition, weak iPhone upgrade cycle, and overvaluation — Lack of meaningful AI innovation could lead to a shift in device form factors and threaten the iOS ecosystem

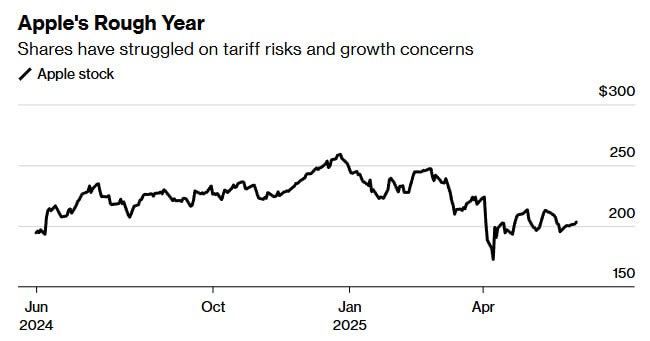

What’s happening with the stock — Down 0.6% in premarket — Year-to-date drop is already 19% — the worst among the “Magnificent Seven” — Analysts increasingly point to Apple’s vulnerability to trade tariffs and political pressure

“To see growth in the stock, we need a new iPhone replacement cycle — and we don’t expect that within the next year,” says Needham analyst Laura Martin.

Wall Street is falling out of love with Apple — In 2025, it was also downgraded by Jefferies, Rosenblatt, Oppenheimer, Loop Capital, and others — Only 60% of analysts now rate Apple as a “Buy” (vs 90% for Microsoft, Meta, and Nvidia) Apple clearly needs a reboot — for now, investors see more risk than upside.

Subscribe to our newsletter!