Disclaimer:

This article is for education purposes only. Also It does not constitute financial advice. Investing in cryptocurrency also carries massive risks, with the potential to lose big sums of money. In brief Here are some Tips for Investing:

1. DeFi Yield Farming

- DeFi provides multiple avenues through which one can earn rewards.

- You deposit your crypto assets in liquidity pools.

- You earn rewards in the form of trading fees or new tokens.

- Risks include impermanent loss.

- Impermanent loss takes place when the prices of the assets in the liquidity pool fluctuate hugely.

- A smart contract vulnerability can lead to losses you do not expect.

- The cryptocurrency market tends to be highly volatile, which affects your return.

2. Crypto Options Trading

- Options contracts grant you the right to buy or sell a cryptocurrency at a specified price within a specific time period.

- Call options give you the right to buy a cryptocurrency at a pre-determined price.

- Put options give you the right to sell a cryptocurrency at a pre-determined price.

- You make profits on the rising prices using call options and on falling prices with put options.

- Options trading includes sophisticated strategies which are studied thoroughly before implementation.

- You can stand a very good chance of losing all the amount that has been invested in case the options go to waste upon maturity.

3. Staking

- You will get rewards based on the staked cryptocurrencies.

- Locking your crypto assets, thereby securing the blockchain network, rewards you.

- New tokens or even fees from transactions become your reward

- If you do not adhere to the rules, slashing penalties could occur and thus result in lost staked funds.

- Your staked cryptocurrency could lose significant amounts in value, further reducing your earnings.

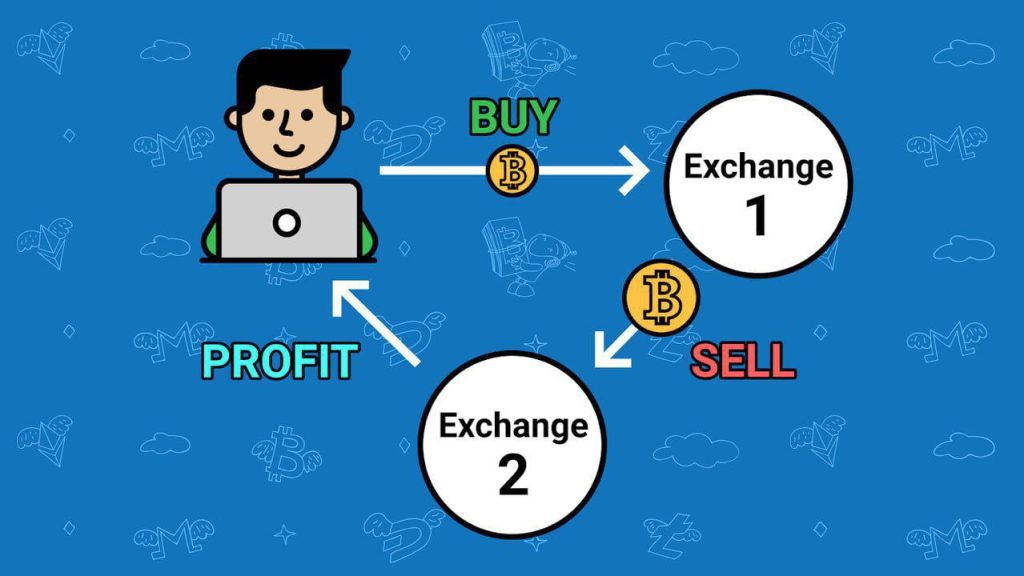

4. Arbitrage Trading

- Arbitrage trading is the exploitation of price differences for the same cryptocurrency on different exchanges.

- You purchase the cryptocurrency at a lower price on one exchange and sell it at a higher price on another.

- It requires fast execution to capture fleeting differences in prices.

- Profit margins are often quite small and also quickly eroded by trading fees and slippage.

- Slippage refers to the difference between the expected trade price and the actual executed price.

5. Algorithmic Trading

- Algorithmic trading executes trades based on predetermined rules and also algorithms through the use of automated trading bots.

- Trading bots will scan the data available in the market, discover a trading opportunity, and place trades much quicker than human traders.

- This would need sophisticated technical expertise to design and also maintain the algorithms.

- There’s always the potential for bugs in the code that would trigger unwanted trades and also losses.

- You could lose control over your money if the trading bot malfunctions or is compromised.

Important Considerations:

- Carefully assess your risk tolerance before engaging in advanced crypto trading strategies.

- Conduct thorough research and due diligence on any platform or strategy before investing.

- Diversify your portfolio across different cryptocurrencies and also strategies to mitigate risk.

- Prioritize strong security measures to protect your crypto assets from theft or hacking.

Are you new to #crypto investing? Start with these steps:

— Klef (@theonlyklef) January 21, 2025

🔹 Research before you buy.

🔹 Use secure exchanges.

🔹 Avoid hype & scams.

🔹 DCA instead of going all-in.

🔹 Stay patient—crypto is volatile!

Like & RT to help someone new! 🔄 #CryptoInvesting #Altseason2025 pic.twitter.com/eDzxDHMte0

Remember: Advanced strategies are not suitable for all investors. It’s crucial to educate yourself and understand the risks involved before implementing them.

Disclaimer: This information is for educational purposes only and however does not constitute financial advice. Because Cryptocurrency investing carries significant risks, including the potential for sunstantial losses.

Subscribe to our newsletter!